By Alianna Tan

Adulting is tough, more so for young adults who spend beyond their means. Are you a millennial who’s struggling with finances? But what if I tell you that if you have Php10,000 or less now, you can start investing and growing money for your future? These days, Php10,000 may not sound like much. It’s so easy to go in a department store and spend it on gadgets, clothes, or food – one swipe of your credit card and it’s all gone. But if you do it right, your Php10,000 can grow and make you a small fortune. The big question now is what should you do to your Php10,000? There are many wise options available, and we have listed down the best tips on what you can do with this amount to kick off a bright future!

- Build Emergency Fund

The first thing that you have to secure whenever you have extra money is to have savings or what we call Emergency Fund. As the name implies, the purpose of this is for you to have something to spend during emergency cases. The best option is to open a savings or time deposit account as it incurs little to no risks to your money. It is never too late to start and emergency fund and while you’re at it, try these money saving challenges to help you keep in track. If you put your Php10,000 in an emergency savings fund will keep putting in money more than you take from it, you’re protecting yourself from future financial stress.

- Get the Right Insurance

Nowadays, being sick comes at heavy cost. You must all recognize that your health is your wealth. You need to be well-covered when you get sick or get into an accident. Furthermore, it’s harder if you are the breadwinner of the family or some people are relying on you, and something unfortunate happens. This is the purpose of life insurance. For as little as ?600 a month, you can already get a ?500,000 maximum benefit limit which you can use for hospitalization bills or for support for your dependents.

Another category of insurance that has seen increasing popularity in recent years is variable life insurance (VUL). It is a permanent life insurance and investment rolled into one which means getting covered for disability, death, and living benefits, with an investment combo. Variable basically means investment return that’s dependent on the rise and fall of the market where your premium will go.

- Invest in UITF or Mutual Fund

Investing in the stock market is very profitable, but it can be overwhelming and complicated for most millennials who are first-time investors. What you can do is to start with less risky type of investments such as UITF or Mutual Funds.

UITFs are pooled investment products offered by commercial banks. Since banks in the Philippines are supervised by the Bangko Sentral ng Pilipinas, you can be sure that UITF investing is safe and scam-free. Similarly, mutual fund is where your money gets pooled with funds from other investors, which professional fund managers invest in different instruments such as bonds, stocks, and money market funds. Because experts handle your funds, you’re assured that they will grow in the long term. You can start investing on either UITF and mutual funs for as low as Php5,000.

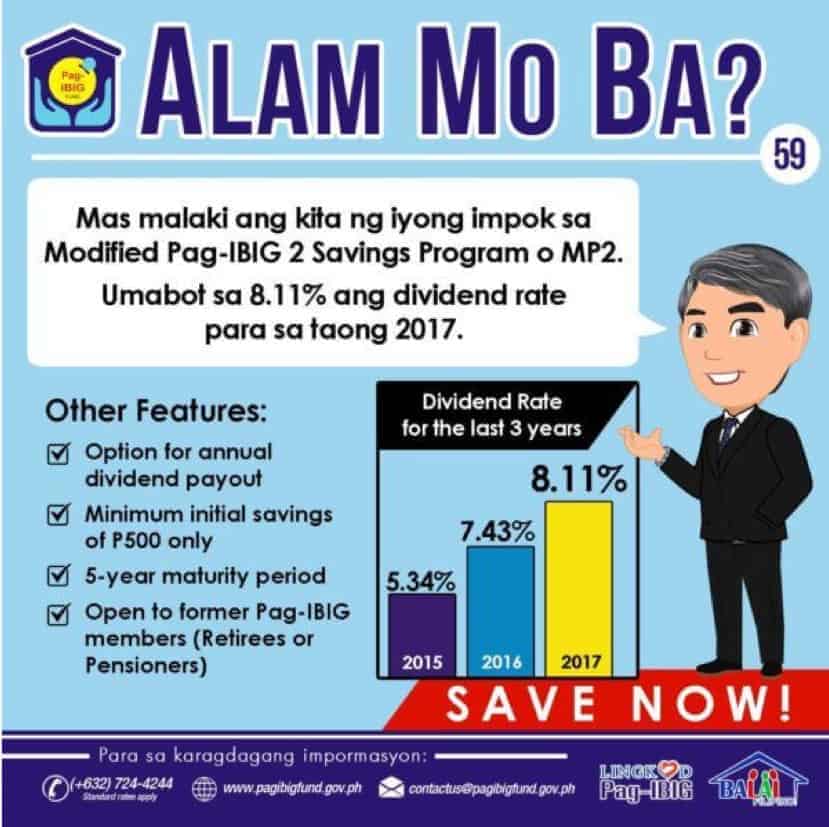

- Try Pag-IBIG/SSS Investment Program

If you have money which you want to grow and you’re willing to be shelved for a few years without withdrawing it, there are investment/savings programs offered by the Pag-IBIG Fund and Social Security System (SSS). For a low investment of PHP 500 or PHP 1,000, respectively, you can start investing in the Modified Pag-IBIG 2 (MP2) or the SSS Personal Equity and Savings Option (P.E.S.O.) Fund. Both investment schemes are guaranteed by the Philippine government, which means you have slim chances of losing your savings. The MP2 and P.E.S.O. Fund are easy to avail, too, as long as you’re a registered Pag-IBIG and SSS member who meet the minimum qualifications. You can enroll over the counter at their branch or via their respective online facilities.

- Start Small Business

If you have free time, skills, and little extra money, why not start venturing into small business? The best thing about starting a small business, especially for millennials, is that it doesn’t require a huge capital and a business degree. Even Php1000 can go a long way, as long as you are smart where to spend and invest your resources.

You can set up a home-based business with very low capital, like putting up a garage sale or selling food via food stalls outside your house. If you don’t want to sell in physical stores, you can try online selling especially now in the advent of technology and social media.

You can also use your skills and talents. If you are into writing, event coordination, painting, etc., you don’t need to have expensive equipment to get started, and your ?10,000 or less will definitely go a long way.

But before you embark on this journey, before you even pick the kind of business you’ll venture into, ask yourself first if you’re really capable and willing to hell out money for it.

- Invest in Yourself

Last but not the least, just like what they always say, your best investment will always be yourself. Invest in things that will feed your soul and fuel your fire to perform better in life. You can learn a new language, or learn how to cook a new dish. Try photography, take writing courses, learn how to create a web site, etc. There are lots of things to learn out there which you can surely use to further improve yourself not just as a professional but as an individual.

Adulting is just difficult now, but keep in mind that growing old broke is harder in the future. As a millennial who still has time, keep in mind that he earlier you save and invest properly, the better your chances of growing your hard-earned money. With the right attitude towards finances, a bright future is surely waiting for you. You got this!