Guide to Philhealth, SSS & Pag-IBIG Voluntary Member’s Contributions

Why continue to pay contributions in PhilHealth, Pag-IBIG, and SSS after employment?

Once adulting hits you, you’ll realize that you already have a lot of responsibilities and obligations. Having a bunch of work makes you crazy, but as long as you enjoy it you’ll understand what you truly desire. And during these trying times, some might have lost their jobs or other sources of income. This means, your payroll will stop and so as your government contributions, but this doesn’t mean the end, you can still continue to pay your contributions under Voluntary Membership.

What would you do first?

You need to update your membership before remitting your Voluntary Contribution to Pag-IBIG, PhilHealth, SSS. It requires your presence, so visit a branch and fill out a form.

Pag-IBIG Branches: NCR | Luzon | Visayas | Mindanao

SSS Branches here

PhilHealth Branches here

Overseas Post here

Note: Don’t forget to change your membership status from employed to self-employed or OFW.

How change membership status (Pag-IBIG)?

1. Download and fill out the Pag-IBIG Membership Data Form (MDF) here

2. Under the Membership Category, mark the appropriate status:

- Self-Employed

- OFW

3. Submit the accomplished Membership Data Form (MDF) together with your supporting documents to the nearest Pag-IBIG branch.

4. Get a Payment Order Form and proceed to the Cash Division to pay your Pag-IBIG contribution.

Requirements for changing your Pag-IBIG membership status to Self-employed

- Two (2) valid IDs (government-issued)

- Latest income tax return (ITR) with last year’s CPA-certified financial statement

- Employee Statement of Accumulated Value (ESAV)

- Business Permit or Mayor’s Permit (you can get it to your municipality)

- DTI or SEC registration under your name

Requirements for changing your Pag-IBIG membership status to OFW

- Two 1×1 ID photos (white background)

- Any valid ID such as a passport or primary ID issued by our government

- Latest valid Contract of Employment with POEA stamp

- Employee Statement of Accumulated Value (ESAV)

- Special Power of Attorney (if someone else will submit your documents on your behalf or authorization letter with your indicated ID)

Note: The ESAV contains all your Pag-IBIG contributions remitted by your previous employers. You can get it from the Pag-IBIG branch where your last employer paid your contributions.

How to update PhilHealth Membership Data Record?

1. Download the PhilHealth Member Registration Form (PMRF) here

2. On the upper right corner of the PMRF, check Updating/Amendment.

3. Complete the form. Under the IV. Member Type, choose the appropriate response:

- For OFWs, check Migrant Worker and Land-Based or Sea Based.

- For freelancers, check Self-Earning Individual and indicate your estimated monthly income.

4. Submit the accomplished PMRF to the nearest PhilHealth branch. OFWs may email their form to [email protected].

5. Wait for the printed copy or email of your updated PhilHealth Member Data Record (MDR).

Requirements for changing your PhilHealth membership status to OFW

- OFW should follow the steps and bring all the requirements needed

- Overseas Employment Certificate (OEC)

- Employment Contract

- Working visa/re-entry form

- Company ID issued by an overseas employer

- Cash remittance receipt for money sent from abroad (at least two months before the last transaction)

- Valid ID or certificate issued in the country of employment

How to change Member Type in SSS

For Self-Employed

1. Download and fill out two copies of the Member’s Data Change Request form (SSS Form E-4)

2. Under Change of Membership Type choose To Self-Employed. Under that field, indicate your profession/business, the year started, and your monthly income.

3. Submit the accomplished forms along with a photocopy of your Unified Multi-Purpose ID (UMID) card. Present your original UMID card as well.

For OFW Members

1. Download and fill out three copies of the Contributions Payment Return (SSS Form RS-5)

2. Under Type of Payor, choose Overseas Filipino Worker.

3. Submit the accomplished form to any SSS branch together with your SSS contribution payment for the applicable month or quarter. Your SSS membership status will be changed to OFW upon posting of your payment.

How much is my Voluntary Contribution?

Your contributions to Pag-IBIG, PhilHealth, and SSS is dependent on your budget. But, a fixed part of your monthly budget can help you to not miss one.

Pag-IBIG Voluntary Rates

PHP 200 is the minimum of your monthly contribution. Again, it depends on your budget. The higher you pay the more it will increase the cost of your Pag-IBIG benefits.

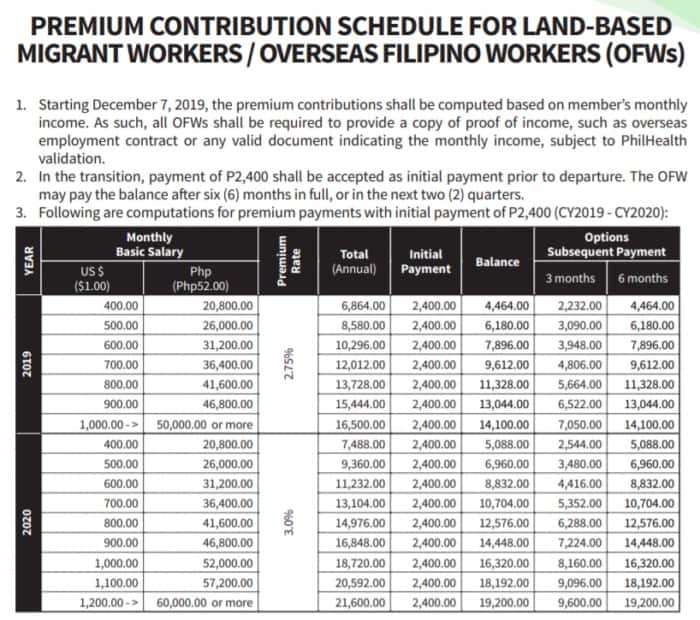

PhilHealth Voluntary Rates

The previous increase form 2.75% to 3% contributions of OFW has been suspended by President Rodrigo Roa Duterte due to the public cry as it adds burden to them.

Voluntary Members/ Self-Employed: P300 monthly or P3,600 yearly

Land-based OFWs: minimum of P7,488 per year (can be paid in advance for 2-5 years)

Seafarers: Same salary-based premium contribution rate as employed PhilHealth members (Those earning P40,000 and above monthly pay a P1,100 monthly contribution)

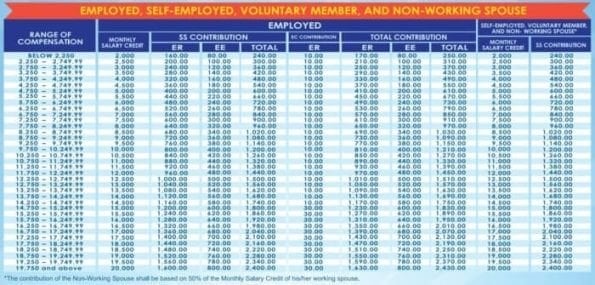

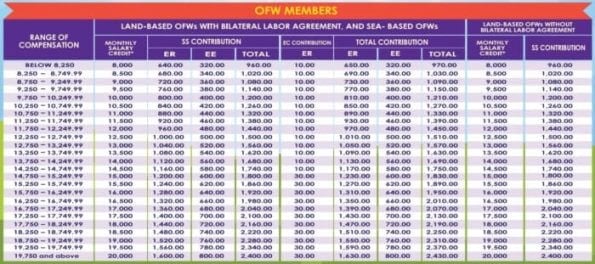

SSS Voluntary Rates

Self-Employed and OFW will have the same SSS contribution rate of 11% of the monthly salary credit, which is based on the monthly income declared in your record.

What is the best way to pay bills?

If you want your payments to be posted in real-time, it’s best to pay directly through their branch or legit agencies to avoid unnecessary issues.

You may also pay through Bayad Centers, SM bills payment counters, and Robinsons Business Centers. Please be advised that posting payments from this channel may take up to 3 days unless otherwise stated.

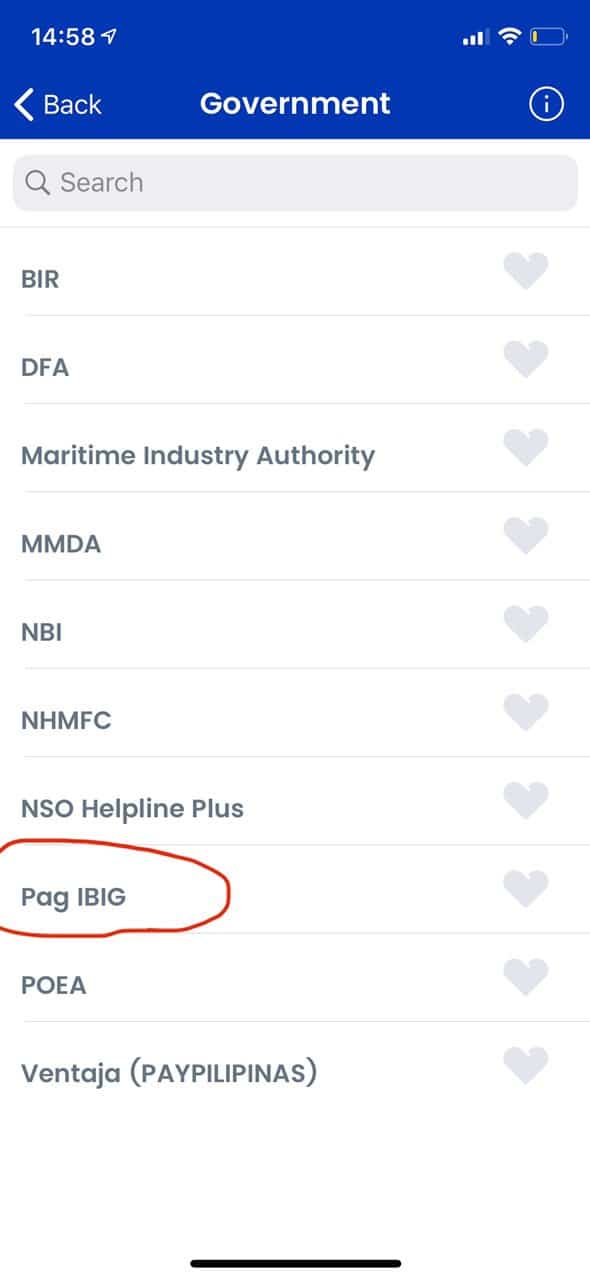

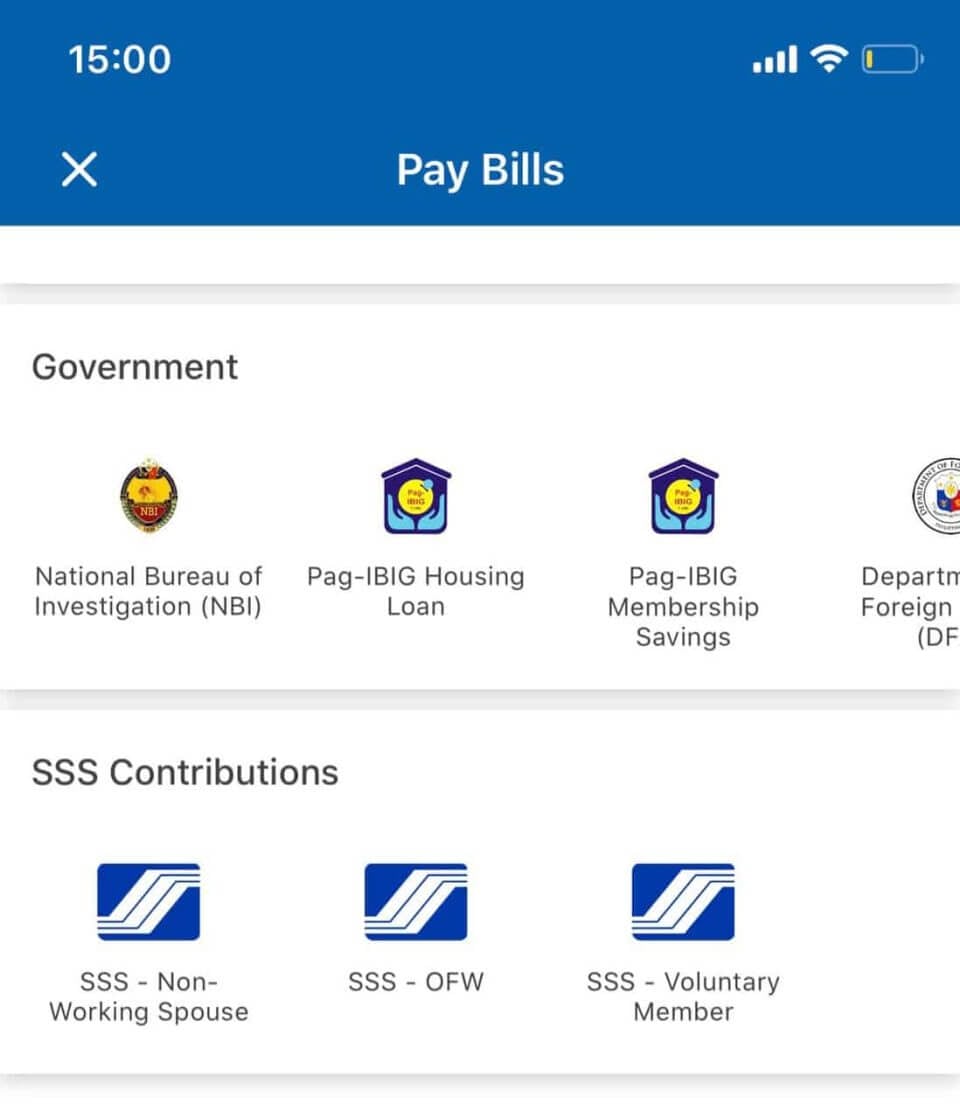

You can also pay the government bills through Gcash but it currently accepts payments for Pag-IBIG

While on coins.ph you can pay Pag-IBIG and SSS.

OFWs can pay through I-Remit and Ventaja International branches abroad

Pag-IBIG Payment Options

Freelancers and OFWs have a variety of payment gateways to choose from, you can also pay using Mastercard or Visa credit cards here. OFWs can also pay in AUB and PNB branches in the country they are in.

Other payment facilities:

SM Business Centers

SM Hypermarket

Save more

Bayad Centers and it’s Authorized, Partners

LandBank

Metrobank

711 (Through EC Pay)

M Lhuillier

Cash Pinas

GCash

PhilHealth Payment Gateways

Asia United Bank

Bank of Commerce

Bank One Savings & Trust Corporation

Bayad Center outlets and accredited agents

Camalig Bank

Century Rural Bank

Century Savings Bank

China Bank

China Bank Savings

Citystate Savings Bank

Development Bank of the Philippines (DBP)

EastWest Rural Bank

LANDBANK

Selected local government units

Maybank

Money Mall Rural Bank

One Network Bank

Overseas Filipino Bank

Genbank

Philippine Business Bank

Philippine Veterans Bank

RCBC Savings Bank

RCBC

Robinsons Bank

Rural Bank of Bambang

Rural Bank of Jose Panganiban

Rural Bank of Sta. Catalina

Saviour Rural Bank

SM Business Centers and bills payment counters in SM Supermarket, SM Hypermarket, and Savemore

UCPB

UCPB Savings Bank

UnionBank

PhilHealth Online Payment: (For employers only)

Employers can conveniently pay their employees’ PhilHealth contributions through any of these online banking facilities:

BPI ExpressLink

Security Bank Digibanker

UnionBank’s OneHub.Gov

BancNet e-Gov (for clients of BancNet-member banks)

SSS Payment Facilities:

Asia United Bank (AUB)

Bank of Commerce (BOC)

Bank One Savings Bank

First Isabela Cooperative Bank (FICO Bank)

Partner Rural Bank

Philippine Business Bank (PBB)

PNB Savings Bank

Rural Bank of Lanuza

Union Bank of the Philippines (UBP)

United Coconut Planters Bank (UCPB)

Wealth Bank

When do you need to pay?

Always pay your dues before the due date to avoid penalties and charges.

Deadlines for Pag-IBIG

Monthly Deadline – is always 10th day of the following month

For example, Paying for September, your due date is 10th of October

Quarterly Deadline – is always 10th of the next quarter

For example, Paying for August to October, your due date is 10th of November

Deadlines for PhilHealth

Monthly: Last working day of the applicable month (If you’re paying for July, your deadline is July 31st)

Quarterly: Last working day of the applicable quarter (If you’re paying for July to September, your deadline is September 30th.)

Semi-annually: Last working day of the first quarter of the applicable semester (If you’re paying for July to December, your deadline is September 30th.)

Annually: Last working day of the first quarter of the year (If you’re paying for January to December 2019, your deadline is March 31st, 2019.)

Deadlines for SSS

The Last Digit of your SSS number will be your due date. Monthly or quarterly is your choice of remitting your contribution.

1 or 2: 10th day of the month following the applicable month or quarter

3 or 4: 15th day of the month following the applicable month or quarter

5 or 6: 20th day of the month following the applicable month or quarter

7 or 8: 25th day of the month following the applicable month or quarter

9 or 0: Last day of the month following the applicable month or quarter