SAVINGS seems like a taboo word for most of us, especially during this global crisis. Some may even say that you’re lucky to have your grocery list still in total capacity despite the pandemic. But these savings should not be set aside, and we know it can be challenging just by thinking of the bills knocking on the front door.

Despite all that is happening nowadays, a new variant of the Coronavirus is paralyzing the economy again. So it’s just as essential for us to think about the future and start saving. So if you want to open a bank account, stash off a few bucks in there to keep it in the future; the good news is that plenty of local banks allow you to save, even with low to zero maintaining balance.

We’ve compiled the best and must-check banks in the Philippines so you can start saving—think of it as your ticket to your dream vacay once this pandemic is over.

But why do I need to worry about the account’s maintaining balance?

Most banks provide their clients with deposit accounts. The terms and conditions of these accounts state how much opening balance is required to open, the amount of interest earned, and the interest earned per year. Furthermore, age can be a deciding factor in selecting the account holder, which is usually the case with children’s savings accounts.

Another factor to consider when opening a bank account is the ability to maintain a balance. This refers to how much money the banks require you to keep in your account.

How is keeping a balance necessary for banks?

Keeping and managing accounts incur costs for banks. The banks recover these costs by pooling deposits from deposit accounts into a capital base that can be used by individuals and businesses for borrowing, investing, and earning income.

The bank cannot optimize its banking activities from accounts with no deposit or with deposits that do not meet the minimum balance requirements.

As a result, they encourage people to maintain a certain minimum deposit level.

In case the minimum maintaining balance is not met, what happens?

When the deposit is less than the balance required by the bank for two consecutive months, the following consequences occur:

- Service charge

- Incapable of earning interest

- Change of account type

- Closure of accounts

We all don’t want to deal with this stuff, but it’s best to know the setbacks. Good thing there are plenty of local banks that allow you to open up savings accounts with low maintaining balance; some even offer a whooping zero maintaining balance!

Let’s check them out!

East West Bank Basic Savings Account

One of the most affordable savings accounts, East West allows you to open an account with an initial and maintaining deposit of P100. Upon reaching P500 in your account, you’re entitled to earn interest at 0.25%.

Initial Deposit: P100

Maintaining Deposit: P100

Interest Earning Balance: P500

Documentation: Electronic Statement

Access: ATM, POS, Online

OTC transaction fees: P100

BPI Easy Saver

BPI’s lightest savings account is the BPI Easy Saver which allows you to open an account for an initial deposit of P150. While you will be charged a one-time fee of P50 for the Express Teller Card and P5 charge for transacting at any BPI Automated Teller Machines, this savings account does not require a maintaining balance to keep active.

Initial Deposit: P150

Maintaining Balance: Php 5 pesos

Express Teller Card fee: P50

ATM transaction fee: P15 (non BPI banks)

OTC transaction fee: P100

RCBC Basic Savings Account

RCBC offers their basic savings account at an initial deposit and maintains a balance of P500. No charges for transactions made via RCBC ATMs or for the physical debit card.

Initial Deposit: P100

Maintaining Balance: None

Landbank ATM Savings Account

Much like RCBC’s savings account, Landbank’s ATM savings account has a P500 initial deposit and maintaining balance requirement. However, this account also allows you to earn interest at 0.25% per annum with a required daily balance of P500.

Landbank savings account interest rate

Initial Deposit: P500

Maintaining Balance: P500

Required Daily Balance to Earn Interest: P500

Interest Rate: 0.25% p.a.

Maximum Withdrawable Amount/Day: P50,000

Documentation: ATM Card

Maximum POS Transactions/Day: P50,000

CIMB UpSave

With a CIMB UpSave Account, you can earn high-interest rates on your deposits. The program is open to Filipinos at least 18 years old and has a mailing address, active mobile phone number, and a primary identification card.

Accounts don’t require starting capital, and they remain open with zero balances. Additionally, no minimum balance is required to earn interest. Instead, the interest is paid out each month.

AUB Starter Savings

Starter Savings at AUB does not keep a balance at all. Additionally, it does not require an initial deposit. Instead, interest is earned on a balance of Php 1,000.

Additionally, the interest is credited to the account every three months. In addition to the electronic statement of account (e-SOA), funds can also be accessed via ATMs, the internet, and mobile banking (which requires enrollment in Preferred Online Banking).

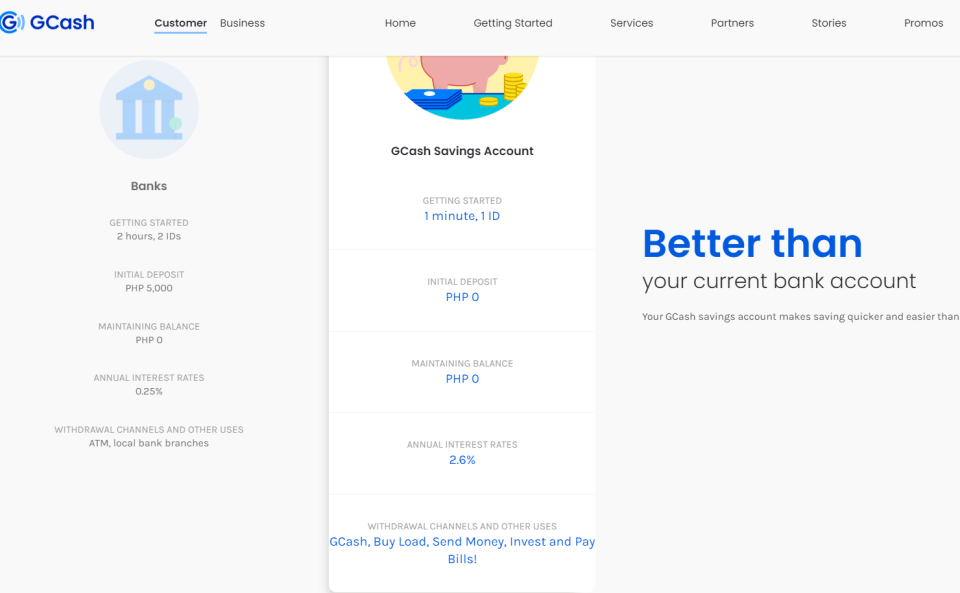

GSave GCASH Account

Most bank accounts do not offer the same interest rate as the GSave Account GCASH account. However, through CIMB Bank, it is possible. Depositors can open an account by downloading the GCash app, activating the account, and submitting at least one valid ID.

There are several restrictions on the account, however. Transactions beyond 12 months are not accepted. When the balance reaches *50,000, no further deposits are allowed. By submitting a biometric verification, one can upgrade their account and lift the restrictions.

The initial deposit and maintaining balance are both zero. Every month, an interest payment is made. As soon as the account is upgraded, a guaranteed amount of *250,000 in life insurance is given free. A minimum balance of 5,000 must be deposited to qualify.

ING Savings Account

Another high-yield deposit product is the ING Savings Account. The digital bank ING offers a special yearly interest rate. Moreover, it does not require an opening balance, a maintenance balance, or an interest-earning balance. Online applications are accepted.

The applicant must have a valid proof of address, be at least 18 years old, and hold any of the following: a passport, a driver’s license, and a UMID. A valid email address and mobile number are also required.

MAYBANK iSave

Maybank offers a no opening balance, zero maintaining balance online-only account. Account-holders can open a new account right away without visiting an office. The mobile app can be used to manage deposits and transactions.

The account holders can take advantage of special promotions on interest rates higher than those offered by other banks. In addition, it comes with an EMV debit card that can be used to access funds from any eligible ATM in the country without incurring any fees.

Over-the-counter transactions are accepted, as well as fund transfers from other banks, GCash, and participating outlets such as 7-Eleven, RD Pawnshop, USSC, etc.

PNB TAP Mastercard Account

PNB TAP Mastercard Accounts can be opened without an initial balance and without maintaining a balance. To earn interest, the depositor only needs to have a daily balance of Php 10,000.

Additionally, it comes with a “Paypass-enabled” Mastercard. You can use it to access your account and check your outstanding balance. Furthermore, Mastercard or Maestro can be used to make cashless payments anywhere these cards are accepted.

The forms can be downloaded from the bank’s website and used to create the account. If they have filled out the forms, they can drop by any branch nationwide. The card’s PIN must be set up once it has been issued. It is also recommended to enroll online to gain access to the account.

CHINA BANK SAVINGS EASI-SAVE BASIC

The Easi-Save Basic savings account offered by China Bank Savings is another affordable and easy to open account. The initial deposit of PHP 100 is incredibly low, and there is no maintaining balance. The interest rate is 0.25 percent per annum with an interest-earning balance of PHP 1,000.

UNIONBANK – PERSONAL SAVINGS ACCOUNT

UnionBank offers many products, but their Personal Savings Account is their only product with a zero balance. The interest rate on this ATM account is 0.10% per annum, the interest-earning balance is PHP 10,000, and the daily withdrawal limit is PHP 20,000. In addition to the UnionBank Personal Savings Account, a Visa debit card can be used at any ATM worldwide, including BancNet.

As a final note

Fortunately, Filipinos have access to several affordable banking products. Savings and money management are made easy with these bank account types because they do not require you to maintain a balance or make an initial deposit, and they have online options to manage and save your money. By doing so, you won’t need to be concerned that the account will be closed due to a lack of funds.

Which local bank are you eyeing? Leave us a comment below!