Doing things online is one of the most convenient ways to do some of your errands like shopping & paying bills quickly and smoothly. In order to do this, you will need to have an online wallet or your online banking.

Bank of the Philippine Islands (BPI) is the first bank in the Philippines and Southeast Asia. As of writing, it is known to be the fourth-largest bank in terms of assets, the second-largest bank in terms of market capitalization, and one of the most profitable banks in the Philippines.

What is online banking?

By definition, it is another way to access your bank accounts online via web or mobile app. It enables customers bank or other financial institution to conduct a range of financial transactions through the website.

BPI Online Banking is an alternative way for those who want to skip the long lines in some branches. This allows the users of BPI & BPI Family to access their online baking round the clock for free.

Is the online experience worth it? Sulit ba?

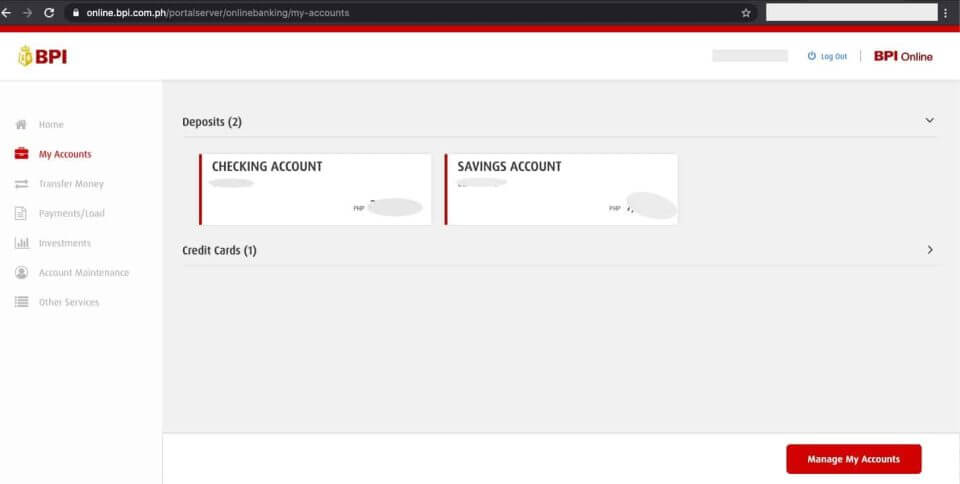

This is how it looks when you first landed on the BPI Express Online page. Simple yet informative. On the left side, you can see the available services you can do with online banking.

Who can apply for BPI Online Banking?

Anyone who has a deposit account, credit/debit card with BPI Savings or BPI Family. In order to access other features such as loans, investments, or prepaid cards, active online banking is required.

How to register?

You can follow the simple and easy guide here!

How was the experience?

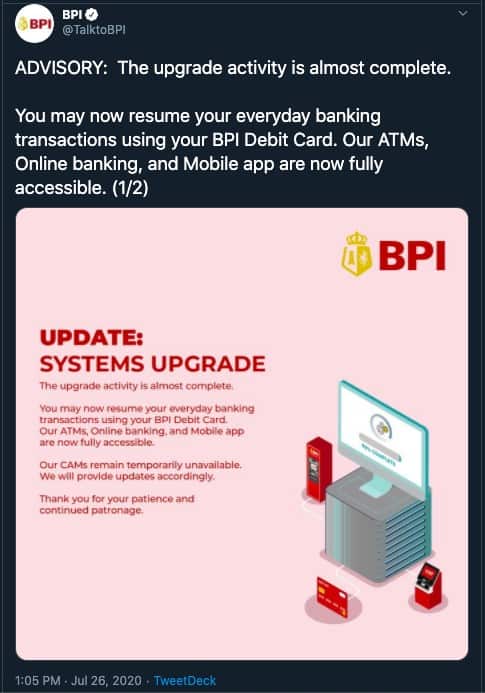

You may experience some problems along the way, as they say, nobody is perfect and there’s always room for improvement! Banks are occasionally doing system maintenance to provide better quality service and is always announced. They always want you to be prepared with whatever you need to do while they are busy making our lives better.

If you experiencing problems or have any concerns, you can always tweet or shoot a DM on their twitter account. They have been responsive and trying to get all your concerns settled.

Here are some of the problems you may encounter along the way

And some reasons why you should have a BPI Online Banking

You can access checking, savings, and your credit card all in one place!

MY ACCOUNT

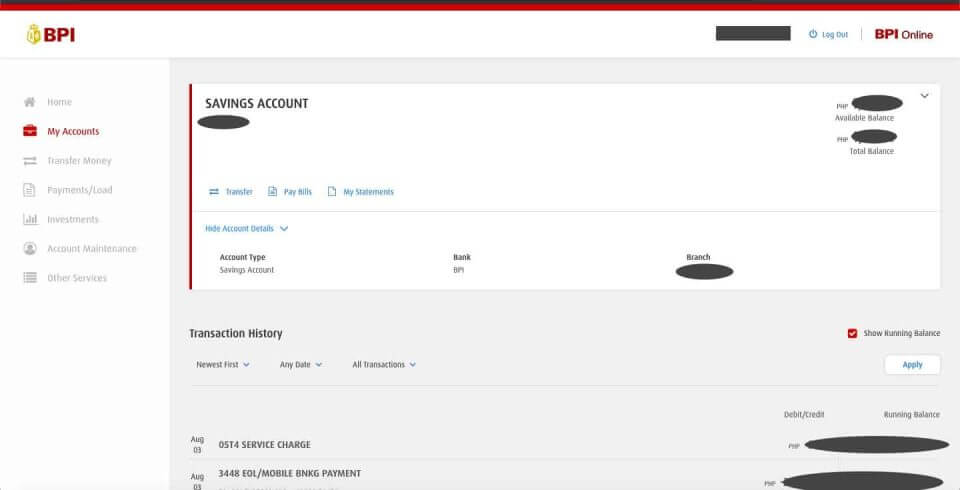

You can view your statement of accounts in case you need to double-check your spending or check if there are any suspicious transactions.

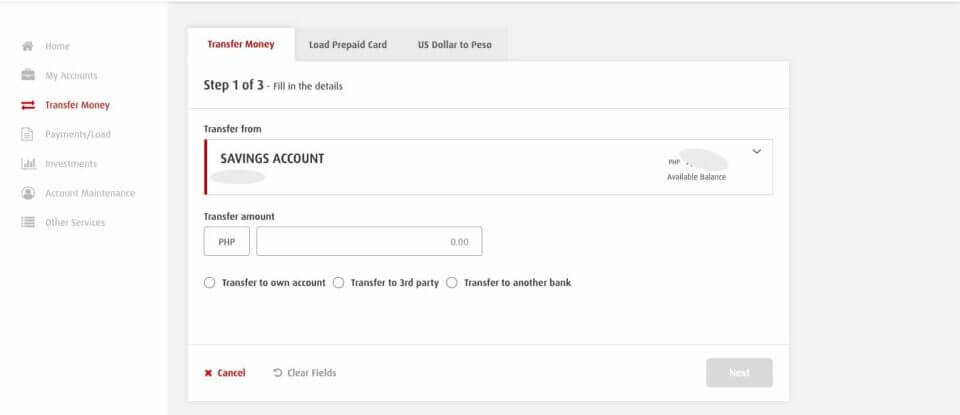

TRANSFER MONEY

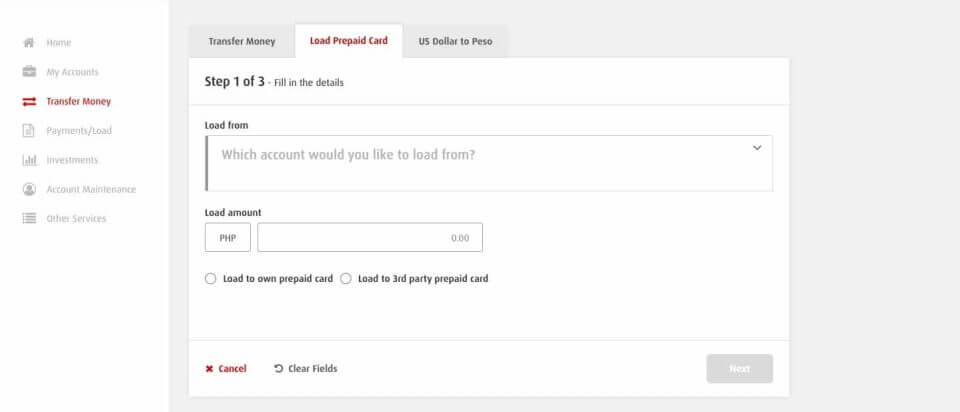

As you can see on this page, you can also do Transfer transactions and Pay Bills. When you click on Transfer, you will see this:

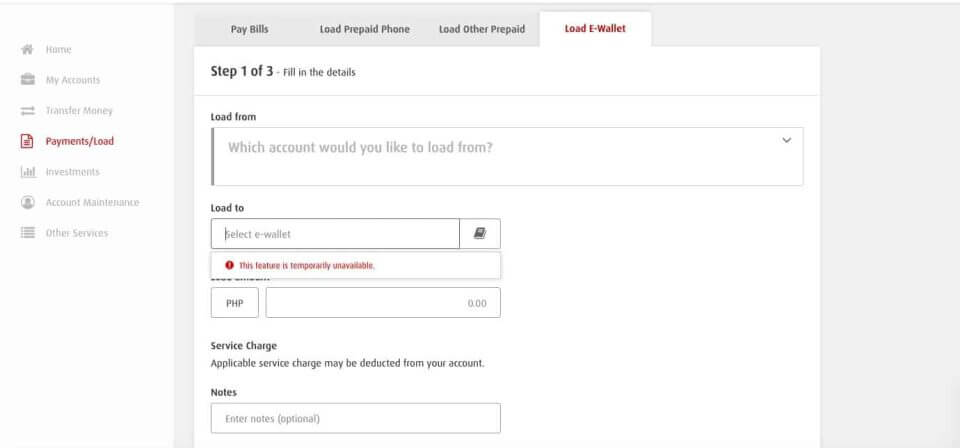

PAYMENTS/LOAD

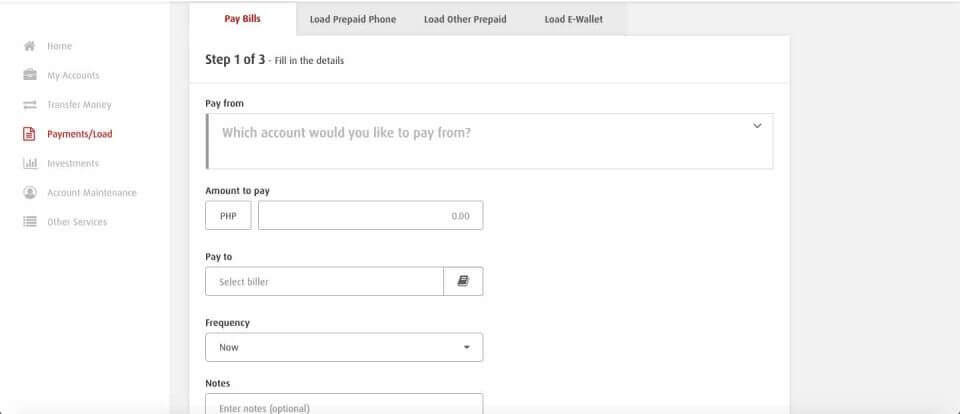

On the Payments/Load tab, you will see additional options for Pay Bills & Load E-Wallet:

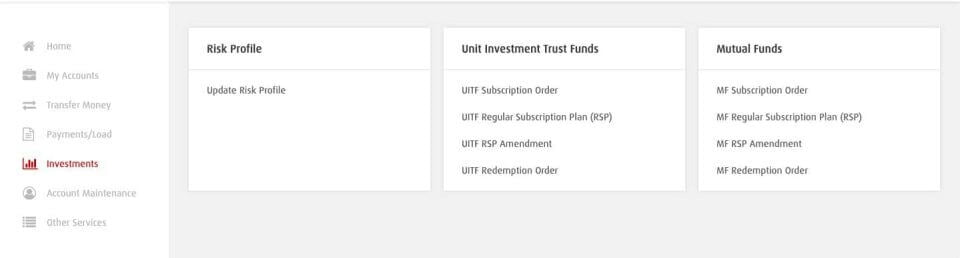

INVESTMENTS

If you have an existing Investment with BPI you can also check it here:

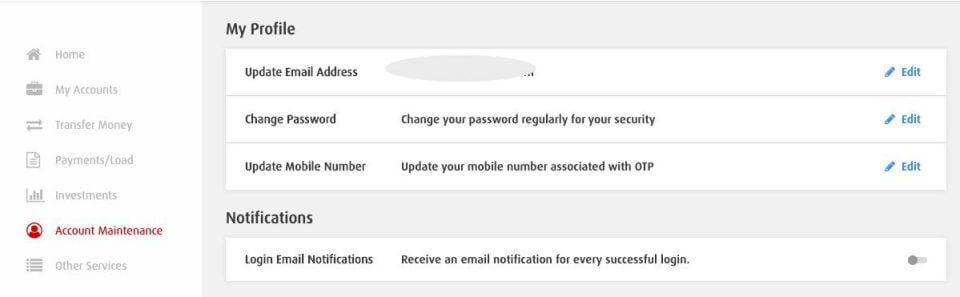

ACCOUNT MAINTENANCE

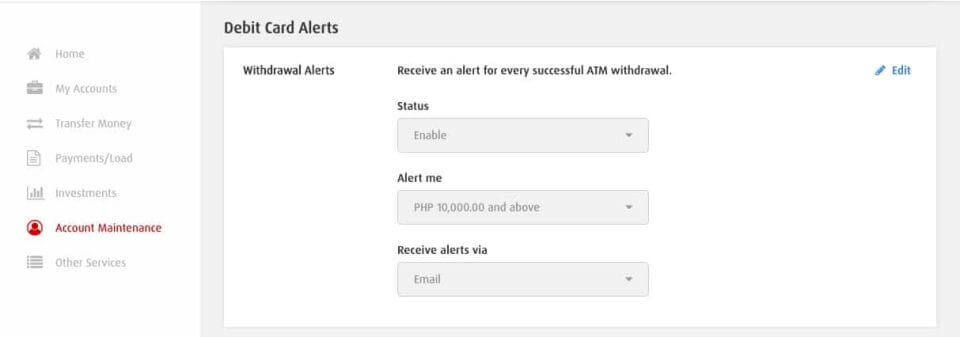

Under Account Maintenance, you can update your email, password, and phone number:

Please note that in updating your mobile number, you will need to activate this request on ATM machine.

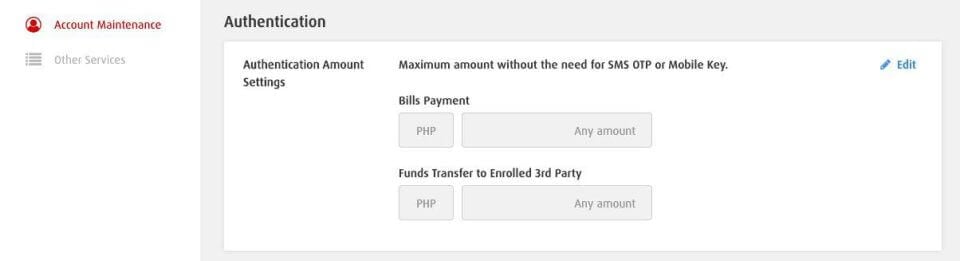

Set alerts on for every withdrawal transaction you make: Set an amount where you will need to require an OTP:

Set an amount where you will need to require an OTP:

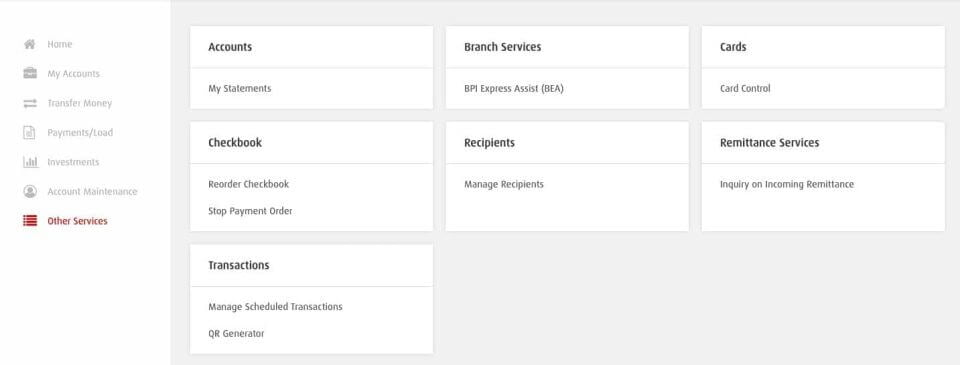

OTHER SERVICES

OTHER SERVICES

In this section, you will be seeing more options for you to customize your card or add more services such Remittance services

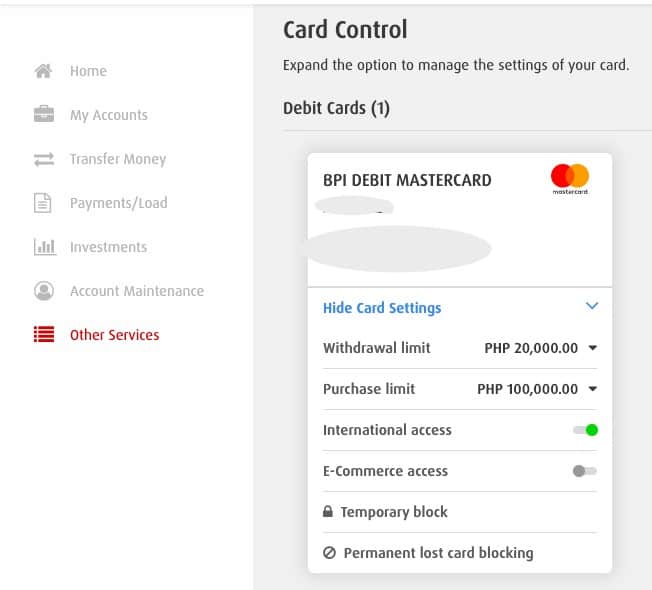

You can increase/decrease your withdrawal and purchase limit. You can choose if you want to enable your card to be used in online or international purchases. If you accidentally lost your card, you can block it from the app to prevent other people from using it.

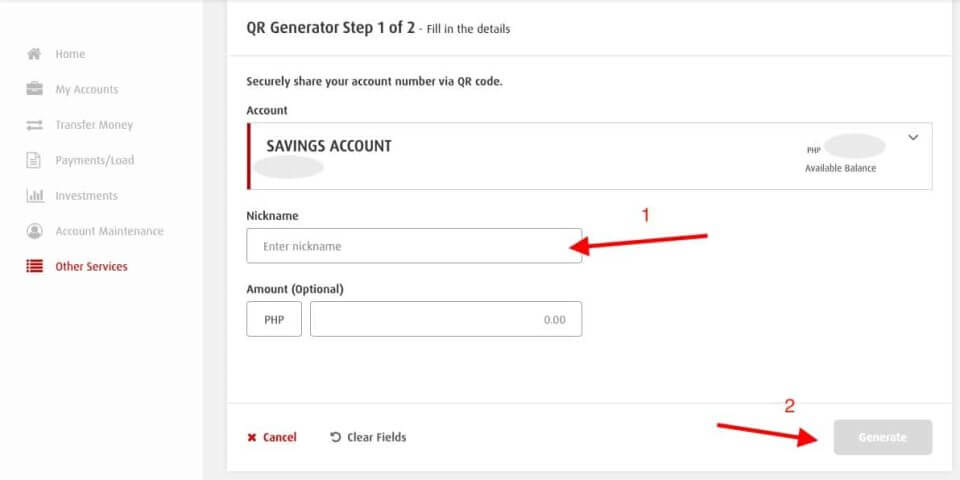

You can generate a QR code here and give it to those you are expecting payments from. Just put any name you prefer, and amount if needed.

Some things can be easy and helpful at the same time. In a few clicks, you have run some of your errands while sitting down, eating, or whatever you are doing AT HOME.

We hope everyone is safe and keeping up with this pandemic. Everyone is struggling but please don’t lose hope. We’re all in this together.