by Abby Ng

It is undoubtedly a challenge to find ways to save money and time in a very busy metro. New trends are introduced to the market before we even have a chance to hop on the old one. Here are seven tips that can help you make the most of your time and money while still letting you enjoy the occasional pamper day.

Plan ahead

Planning ahead saves you a lot of time in stores and prevents you from buying unnecessary items you only think you need. The idle time you may have could be used for something more productive. Make a list of the things you need, set a reasonable budget, and shop wisely.

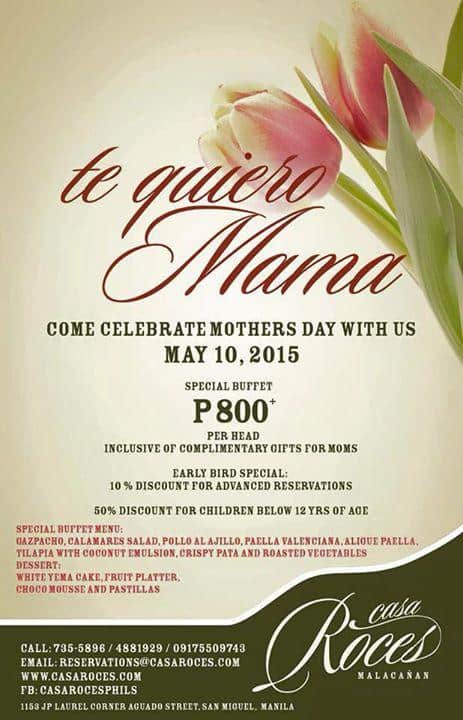

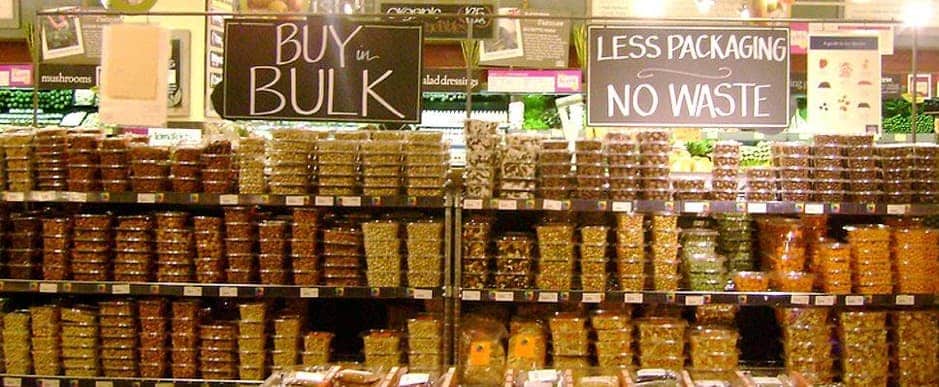

Buy in bulk

Buying in bulk will require less trips to the grocery, which saves you more time and money. It is also eco-friendly because it minimises transport pollution and helps reduce packaging waste when you bring your own reusable bags and containers. Just make sure to bulk-buy things you know you will regularly use so you do not waste money by having the items ending up spoiled or stuck in storage.

Be practical

We can’t blame you for wanting to join a trend, but this is not always practical especially if you’re on a budget. Do you really need your own airpods or a new pair of sneakers or are you trying to be a part of a trend that changes every two weeks anyway? Be practical and buy what you really need, and give yourself a small treat from time to time that doesn’t hurt your pocket too much.

Buy secondhand or refurbished items

Can’t shrug off the need to buy a new pair of jeans? Visit a thrift store and get the chance to purchase some vintage pieces for less. Thrift shopping also combats fast fashion, so you get to help save the environment while getting yourself something new. You can also buy refurbished items that you may need around the house to save more money while incorporating some unique elements in your home.

30-day rule

The 30-day rule is most effective for impulse spenders. Whenever you feel the urge to buy something new, convince yourself to think about it for 30 days. If you still feel like you need it then, you may allow yourself to buy it. You’d be surprised by how much you can save and how many items you did not actually need as much as you thought.

Track your expenses

There is a lot of power that comes with having your own credit card and bank account. While it gives you your needed independence, it can also allow for relentless spending. Save more money by keeping your receipts or simply download an app where you can keep a record of your expenses. This shows you how much you are spending, how much you can save, and how you can budget your money better.

Set your own savings goals

Whether you are a student, employee, or employer, having savings could literally be a lifesaver. Think of something you need to save for — you could be needing some extra funds for your thesis, or perhaps you’re planning to get your own apartment. Even if you do not have anything big to spend for, save anyway because you will be needing it one day. Think about how much you will need and how much you need to save per week or per month to reach the goals you have set for yourself. You can also start by automatically saving 10-20% of what you earn so you have enough saved when you need to spend for something at the last minute.

With improving technology, new styles in fashion, and endless innovation, it can be a struggle to stop yourself from buying items you might not really need. Take a minute to step back and assess whether you need it or not, without thinking of how the product or service is marketed to you. Think about whether or not you will need that in the future or if it can contribute to your long-term goals. Also consider what you may already have at home and how you can make the most out it to make sure you get your money’s worth. Saving money is always difficult at the beginning but very doable when you find the routine and practices that suit you.